Table of Contents

It was the day after I had completed the sale of my business which had provided us with a living for the past 6 years. The business which had supported the life of myself, my wife and our two children. I woke early and turned on the laptop; opening my email…..EMPTY.

My body exhaled as I sat thinking of what to do next. A tinge of sadness mixed with a whole sense of relief. I was physically and emotionally exhausted.

You see our business was never the typical start-up of long hours and late-night working. Ok, we did the occasional fire fighting but overall it was a humble, steady business. But here’s the rub. Business is all-consuming.

I was never off. Even on holiday, I would have a tiny niggle in the back of my mind. ‘What if there’s a support ticket? I wonder if the team are working on the new materials for the next curriculum?’. I was completely invested.

Don’t get me wrong, I took a ton of time off….but I was always ‘on’.

It took a couple of weeks to adapt to the change of pace and my new life. I still had a little bit of work via a remaining website and equity in a business but my day to day work was gone.

As my handover duties began to evaporate I was beginning to ease even more. Bike rides, even more time with the family and thinking about my next steps.

Financial Planning:

My first step following my decompression stage was financial planning. How can I plan our families finances where we feel comfortable in the short, medium and long term?

Step 1: Low-cost index funds:

My investment profile has always been simplistic. I’ve followed and largely enjoyed the FIRE movement for some time now. The key principles are solid as is whole marketing index funds via an established company like Vanguard (my personal choice).

I aim for an average 7-8% growth year on year. I keep investing consistently and always pay myself first. This was something I did before the business sale and will continue to do so for the years to come.

Having spoken with my accountant I worked out the efficient amount to invest in my Pension and have done so.

Step 2: New Car

I’m a huge advocate of used cars. Our car was a Seat Leon estate with over 100,000 miles on the clock. Although it was still in good condition we plan to drive on holiday for the foreseeable and as a result wanted something a little newer. After death by spreadsheets we opted for a VW Touran and bought one with just 5,000 miles on the clock.

I’m not a huge fan of consumer debt away from the mortgage (especially for a depreciating asset) so this was bought cash and free of any finance. We plan to keep this for a significant period of time.

Step 3: Remortgaging

I’ve already mentioned my decision to go with an ‘interest-only mortgage’ however as a family we spent a considerable amount of time discussing the pros and cons of paying off the mortgage, leaving it as is or paying a large chunk off and moving the rest to interest-only.

We decided after some deliberation to hedge our bets and go with the interest-only option. Paying the mortgage off felt so final and really poor use of low-interest rates however staying as we were also felt like too much debt and not enough balance.

Having fixed for 5 years for a monthly fee of less than some pay for a week of shopping, it’s a decision removed from my mind so I can channel my energy elsewhere.

Step 4: Finish house renovations

Despite finishing the main bulk of the renovations and building work before the sale we still had a lot of jobs remaining, Internal painting, new carpets, curtains, blinds, the garden amongst everything.

These have now largely been finished. Anyone who has worked through a property renovation will know the mental space having someone in your home constantly fills. Distractions, less personal space and the inability to get any deep work completed.

Finishing this work (and the expenditure) has given me the headspace to focus elsewhere.

The end of the summer:

By the end of the Summer, I began to feel excited about working again. I practically spent two months with my family while escaping for a few hours to the laptop. But my work burnout had disappeared and it was replaced by anticipation and enthusiasm to work towards new goals.

My goals are however a little different to before. I am no longer pushing as hard but looking for a level of balance between making money and enjoying life.

The appetite to make & not spend money:

Whereas previously my primary goal was to grow a business that would be an attractive acquisition, my goal now is not to spend the money earned from the subsequent sale and channel that money into passive investment opportunities. I believe the hard work has been done and now it’s purely a case of staying the course, investing well and keeping my brain and body healthy (through work, recreation, social, exercise).

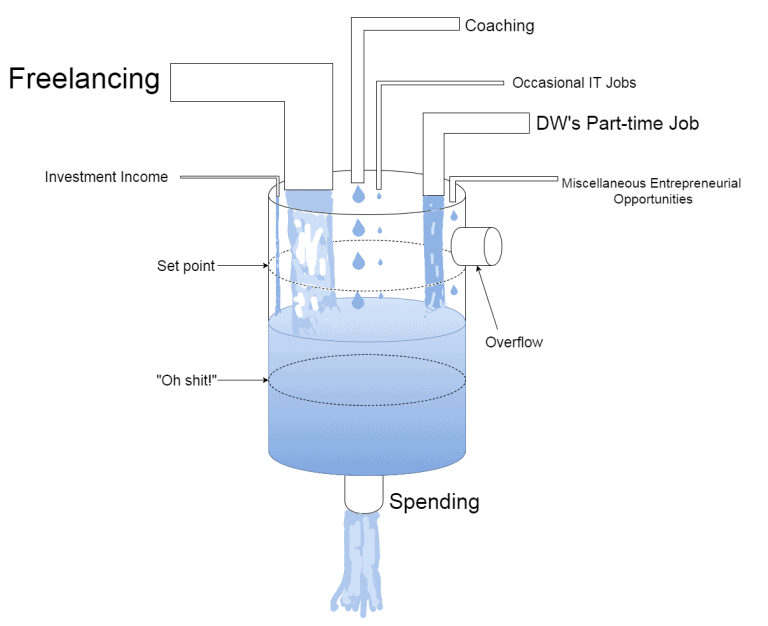

One of my favourite analogies was the ‘tanks and taps’ by Andy at Liberate.life (now no longer accessible other than via Wayback). The basic premise is that the tank leaks as a result of your monthly spending, however, you can keep it topped up in a number of different revenue streams (known as taps).

As I’ve alluded to previously, our monthly spending is modest and my money making goals now are to meet our monthly obligations without tapping into the investments.

How will I do this?

Subscription Website:

I have one remaining subscription website which is a primary focus of mine. It’s suffered badly with a lack of focus & poor migrations however has a great team in place, healthy bank balance and subscriptions are starting to improve.

I’ve worked hard recently on creating a new content strategy and things are starting to look up. I am confident this will deliver at least a basic salary within a year.

eLearning Business:

As alluded to previously I have equity in an eLearning business that is growing rapidly year on year. We have an unbelievable team, the other Directors are the nicest people you will ever meet and it’s already paying me a basic salary for the work I do on a monthly basis. As part of my ‘tanks and taps’ strategy, I want multiple revenue streams of various shapes and sizes. The goal is purely to match our living expenses and when I have enough I will stop working.

Tiny bit of freelancing work:

I still hold a ‘tiny’ freelancing job for a client I have known for a long time. The relationship is super chilled and things are going so well for the client that I keep hold of it. It’s also another tap in my multiple income stream strategy.

But my days of freelancing on a regular basis are for now over. Never say never but I am hoping to make money largely on my own terms.

Other exciting opportunities:

I have a couple of other exciting opportunities I am looking into/exploring. They are completely outside my comfort zone but I will be approaching them with caution. I plan on documenting the process of these opportunities so I will keep them secret for now.

So my appetite for making money is back but with a huge shift from my business growth days.

How is your appetite for making money? Did you suffer from a lack of motivation or burnout throughout the pandemic or other life events? I’d love to hear from you.